Mezzanine Financing

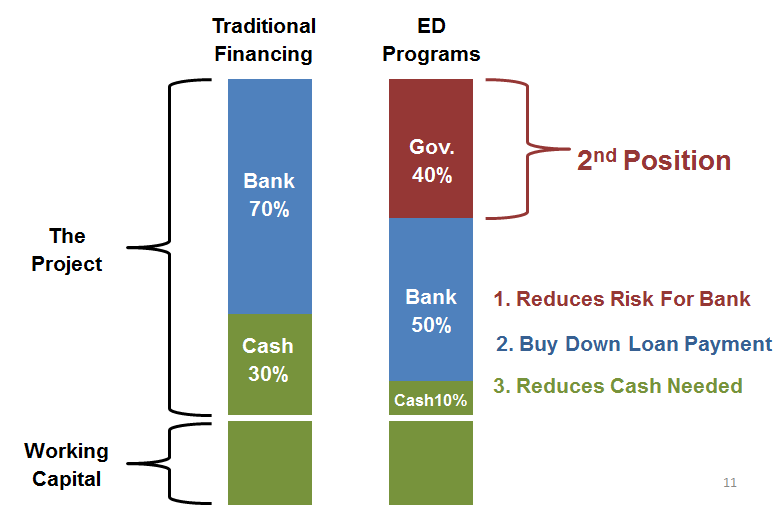

Also called 50/40/10 financing programs, these often subordinated loans are the most common non-traditional financing programs available. In short a second lender or intermediary makes a loan in conjunction with a bank to close a financing gap. The goal of this financing is often to:

- Remove risk from the banks point of view

- Drive out the term of the loan, decreasing monthly payments

- Allow for less collateral

- Lower down payment

Common Mezzanine Programs

SBA 504 Loans

The U.S. Small Business Administration established the 504 loan program to help businesses purchase or expand commercial real estate and acquire equipment while preserving working capital. A 504 loan puts such fixed-asset projects within reach for small businesses by requiring lower down payments than conventional financing and providing long-term, fixed-rate interest rates.

WHEDA Participatory Loan Program (PLP)

Partnerships with lending institutions to provide commercial credit for larger projects.

WEDC Business Opportunity Loan

A business must create new full-time positions and/or retain its existing full-time employment base in Wisconsin to qualify. Loan requests under $200,000 will be referred to the appropriate local or regional revolving loan fund first.

Local Revolving Loan Funds

There are loans directly from local governments. It is recommended you contact SCEDC staff to learn which one is the best for your needs. There are several local Revolving Loan programs run by:

- Sheboygan County

- City of Sheboygan

- City of Plymouth Utility

- City of Sheboygan Falls Utility

When installing more efficient equipment there is usually an energy savings. To incentivize companies seeking to reduce their power demand, WPPI offers loans to help make the purchase of this equipment possible. Users of this program must be in Plymouth Utilities service territory.